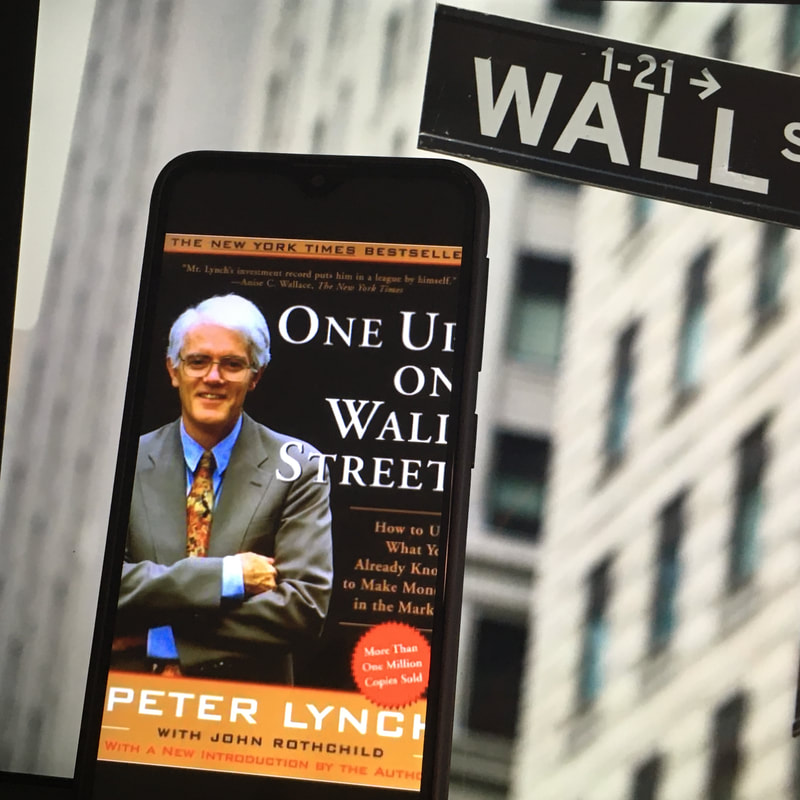

One Up On Wall Street: How to Use What You Already Know to Make Money in the Market by Peter Lynch One Up On Wall Street: How to Use What You Already Know to Make Money in the Market by Peter LynchMy rating: 5 of 5 stars This book easily deserves to be put in my personal list of the top ten finance books of all times. Lynch's "One Up On Wall Street" breaks down investment terms and the right stocks to buy in so simple a way that anyone can understand it. From an entry level investor to a seasoned professional, nearly anyone can pick up some helpful tips on how to improve their game. Here are a few major takeaways that I have learned from this book: 1) Don't rely on professionals. Use your brain and intuition when picking stocks. 2) Try out the businesses for yourself. For example, before placing your investment in a food chain business, why not try out the burger and fries for yourself. Take some time to really know the company and its clients. 3) Research, research, research. Do not invest money in a company that you know nothing about. Pay attention to their press conferences, learn about the CEO, the company's mission, the steps they are taking to continually improve their quarterly and annual earnings. 4) Don't sleep on your investments. Please do not buy a stock of a company and then no longer pay attention to it. Companies are organic, they grow and diminish in time, so it is important to keep an eye on them. Yes, companies will go through natural cycles, but they can also take a negative downturn- for the worst. Frequently revision of your stocks will ensure you are on high alert, ready enough to trade, sell, or potentially buy more stocks when the time is right. 5) Look at the facts. Lynch warns that investors fall into a major trap of being too optimistic or relying on their emotions when playing the game of stocks. He warns that investors should use their head, only pure logic will help you win the game. 6) Only invest money that you are ready to lose. He warns that placing your entire life-savings into a stock is risky business because you have the potential to lose it. He also encourages investors to own a house, before placing a lot of money into stocks, because he believes that a house is a person's greatest investment. As always, Lynch encourages the reader to learn more about Wall Street by describing his experiences in an entertaining fashion. He is humble and transparent, detailing the various ways he has failed in the investment business and how we can avoid it. The biggest takeaway is to not rely on brokers or the media when it comes to choosing stocks, but instead rely on your own intuition and personal relationships with that said business that you wish to invest in. I would recommend this book to anyone that has an interest in finance and investments. It really opened my eyes to the different types of investments, but more importantly where I can invest my cash. There are some moments when the book feels outdated, but it is still relevant to our current times. Wall Street hasn't changed much since this book was published, so there is still something to learn for the avid reader. I look forward to reading more of Peter Lynch's work in the near future. This one is certainly a five star read! View all my reviews

0 Comments

Leave a Reply. |

Archives

March 2024

Categories

All

|

RSS Feed

RSS Feed